Your Money Is Losing Value Every Year if You Don’t Invest in Canada

Download the free Investment Guide for Immigrants and learn how newcomers are growing their money safely — even with small monthly contributions.

Fill in the form below to learn where smart immigrants put their money in Canada

I understand.

As an immigrant, security matters.

You worked too hard for your money to lose it.

But keeping it idle is the riskiest move of all.

Built for Busy Immigrants, Not Full-Time Traders

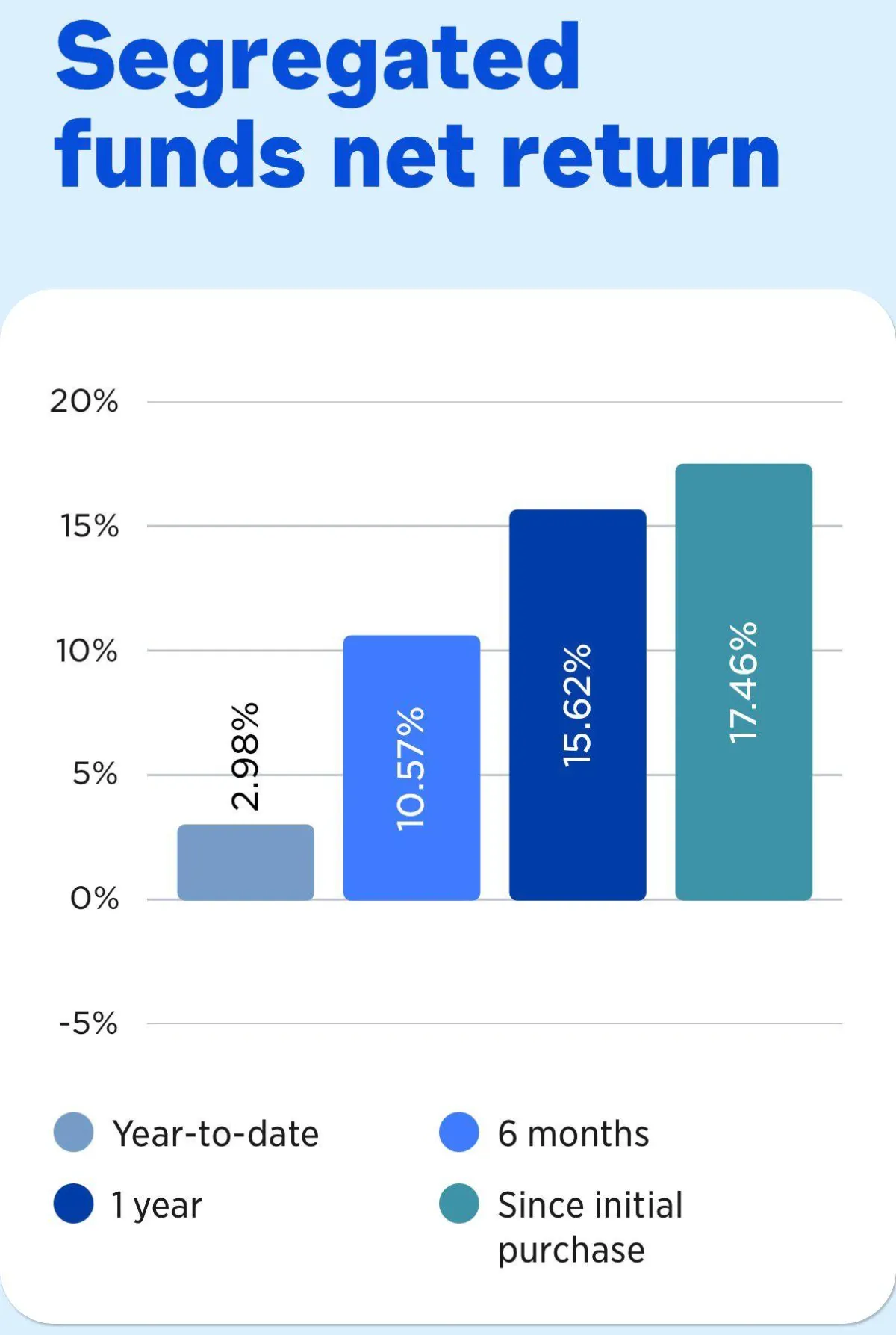

This guide shows how professionally managed funds can be used inside a TFSA or RRSP to target long-term returns of 15% per year.

Below is a snapshot of my investment account, showing 15% annual growth.

The Mistakes Many Immigrants Make With Their First Investments

Waiting too long to invest

Unnecessary trial and error

Stock investing without guidance

Inflation eating your low bank interest returns

Short-term investing rather than long-term investing

I created this beginner-friendly investment guide to help immigrants understand how investing actually works in Canada.

After reading the guide, you will:

Know where to put your money in Canada (and where not to)

Understand the difference between saving vs investing

Learn how managed funds work for beginners

Know how to use TFSAs and RRSPs the right way

Understand how to beat inflation over the long term

Have a clear next step, even if you’re starting small

FAQS

What investment options does the guide cover?

The guide walks through the three main investment options in Canada — GICs, individual stocks, and managed funds — and explains the pros, cons, and when each makes sense, as shown in the comparison section of the guide (page 2)

How do you charge for your services, and are there any hidden fees?

No hidden fees. The guide and the complimentary investment session are free

Does the guide focus on Canadian investing only?

Yes. The guide is 100% Canada-focused, including Canadian investment options, registered accounts like TFSA and RRSP, and strategies that work within the Canadian financial system

Will this guide teach me how to pick stocks?

No — and that’s intentional. Instead of stock picking, the guide explains professionally managed funds, which are often more suitable for beginners and busy professionals who don’t want to monitor markets daily.

Does the guide explain TFSA vs RRSP?

Yes. The guide explains how TFSAs and RRSPs work, how they are different, and how to decide which one may be more suitable based on your income, goals, and stage of life.

© 2026 Femi Financial - All Rights Reserved.